Our clients trust in our high-quality work, experienced people, industry leading innovation, and outstanding service.

Our team's commitment to excellence has earned us recognition as the 2020 American Legal Technology Awards Law Firm Winner, Patent Bots Quality Scores 2022 First Place, and Vault.com's Best Midsize Firm to Work For 2023, including #1 in Firm Culture, Informal Training, Mentoring, & Sponsorship, Innovation & Technology, Selectivity, Hours, Quality of Work, and Satisfaction & #2 in Diversity and Formal Training.

The Strategic Dilemma: Overcoming Double Patenting with Terminal Disclaimers

Navigating New Horizons: Elaine’s Journey Through High-Stakes Litigation to Family-Centric Career Choices

Unlocking the Potential of AFCP 2.0: A Game-Changer in Patent Prosecution

Navigating New Horizons: Elaine’s Quest for Work-Life Harmony in IP Law Continues

Decoding the Signature: The Influence of Patent Examiner Authority on Patent Outcomes

Navigating New Horizons: The Journey of a Lawyer Mom in the World of IP Law

Unveiling the USPTO’s Examiner Production System: Strategic Insights for Patent Prosecutors

Bridging the Gap: Empowering Women in STEM to Explore Careers in Patent Law

Navigating Allowable Subject Matter in Patent Applications: Strategies for Success

Navigating the Legal Landscape: The Supreme Court and the Future of Diversity in Education

Streamlining Patent Prosecution: A Proven Strategy for Navigating Office Actions

Beyond the Marker: Equal Pay Day and the Legal Sector’s Call for Action

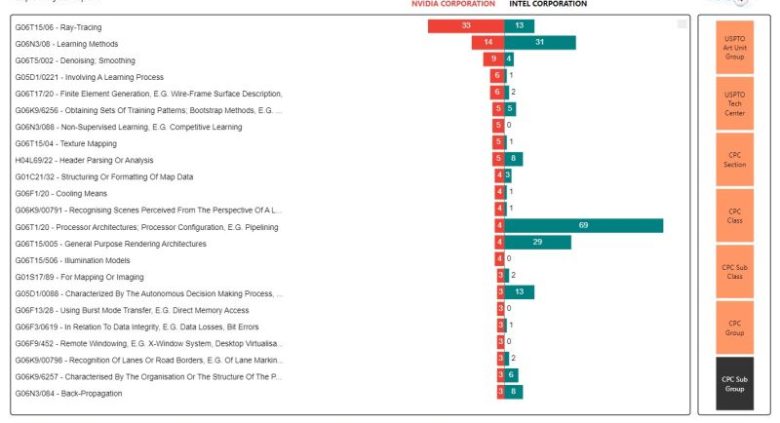

AI Titans: Who’s Dominating the Patent Universe

102 Blocking Patents as an Indication of High-Quality AI Patent Portfolios

Transforming Examiner Interviews into Opportunities: A Practical Guide

Apple Vision Pro: A Patent Look at the New Entrant in Virtual Reality

Inspiring Inclusion in Patent Law: Celebrating International Women’s Day with Heart

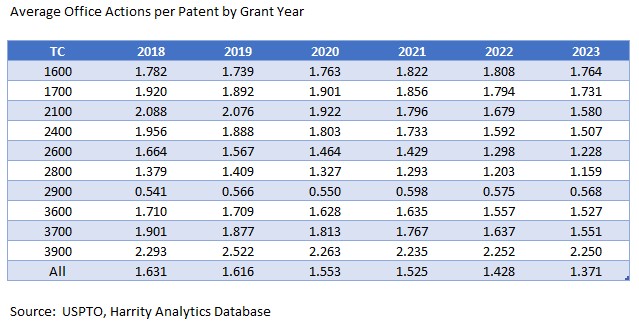

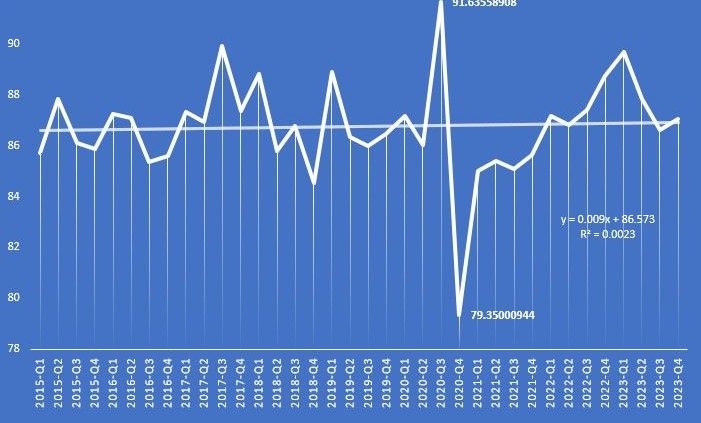

Trends and Implications of Decreasing Average Office Actions Per Patent at the USPTO

Enhancing Patent Prosecution Efficiency: A Strategic Approach to Examiner Interview Agendas

Stella Ennals: A Legacy of Innovation and Independence

The Art of Examiner Interviews: A Strategic Approach for Success

Unlocking Genius: Empowering Black Innovators in the World of Patents

The Underrated Key to Patent Prosecution Success: Examiner Interviews

Bridging the Gap: Elevating Black Inventors in the Patent System

Unveiling the Brains Behind AI Patenting: Leading Inventors Transforming Technology

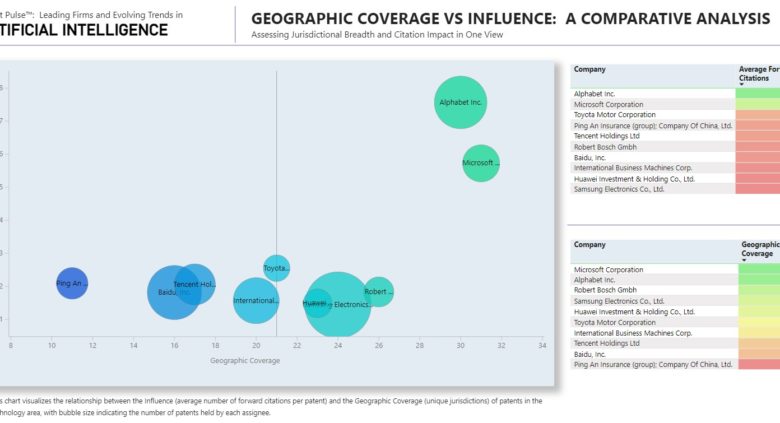

Who’s Conquering the AI Globe? The Patent Showdown Between Reach & Influence

AI Titans: Who’s Dominating the Patent Universe

102 Blocking Patents as an Indication of High-Quality AI Patent Portfolios

Apple Vision Pro: A Patent Look at the New Entrant in Virtual Reality

Trends and Implications of Decreasing Average Office Actions Per Patent at the USPTO

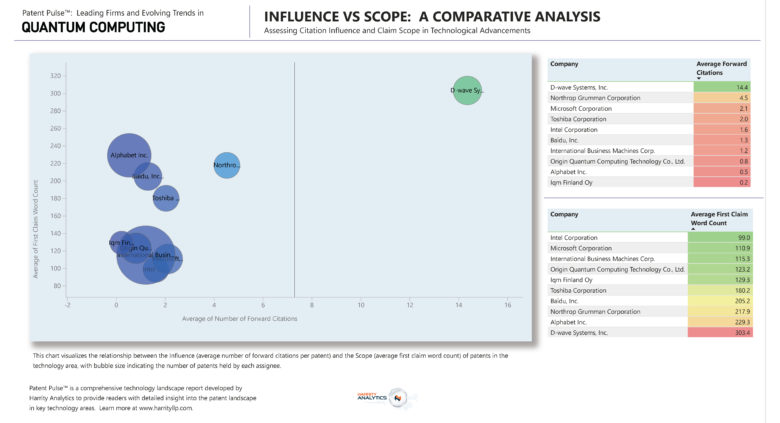

Unveiling the Power of Bubble Charts in Competitive Intelligence: A Quantum Computing Perspective

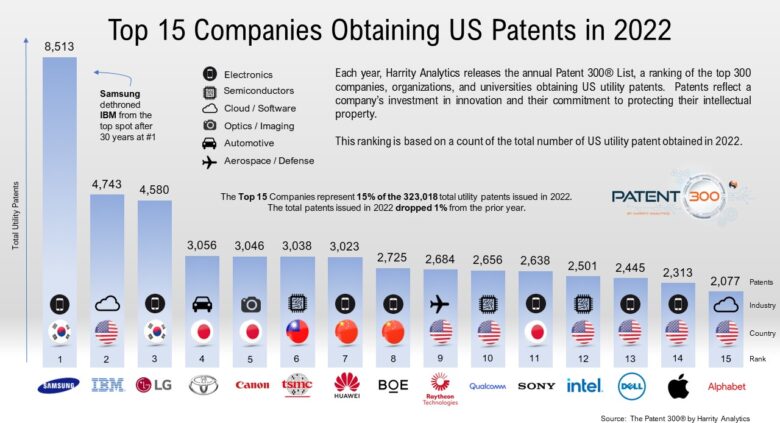

Maximizing Efficiency: A Case Study on Using the Patent 300® Report for Assessing Law Firm Performance

High Level Patent Portfolio Assessment Using Harrity’s Patent 300® Company Report

Patent Data Reveals Unique Continuation Practice Amongst Patent 300® Companies

Inside the European Patent Revolution: An Analysis of Emerging Unitary Patent Data

Analyzing Technology Trends from the 2024 Patent 300® List

Harrity Analytics Presents: 2023 U.S. Patent Office Superlatives

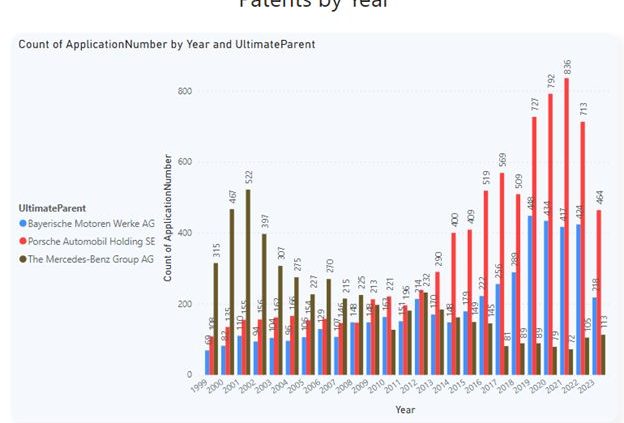

The Evolving Landscape of Automotive Patents Among German Automakers

Monitoring U.S. Patent Maintenance Fee Data: A Look at Strategy Shifts

Leveraging AI in Gap Analysis Reports

Leveraging the Patent 300® Dashboard for Competitive Intelligence

Infographic of the Top 15 Companies Obtaining Patents in 2022

Harrity Analytics’ Top Patent Firms List Featured in Law360

Bloomberg Features Patent 300® by Harrity Analytics

Harrity Ascends to 27th on the Top Patent Firms List, Showcasing Unprecedented Growth

Elaine Spector Provides Data-Driven Perspective at 2024 AIPLA DEIA Colloquium

Harrity Wins ‘Patents Law Firm of the Year in Virginia – 2024′

Harrity Named US News 2024 Best Companies to Work For: Law Firms

Harrity Recognized as an Inclusive Workplace by Best Companies Group

2023 Harrity Holiday Gift Guide

Harrity 4 Charity Announces 2023 Charitable Contribution Matching Campaigns

Revolutionizing the Patent Landscape: The ‘Driving Diversity’ ADAPT Webinar Unpacks the Future of Diversity in Patent Law

Rocky Berndsen Recognized as World Leading IP Strategist in 2023 IAM Strategy 300 List

Paul Harrity Featured in Washington Lawyer Magazine

Paul Harrity and Elaine Spector Named 2023 Patent Stars in MIP’s IP Stars Rankings

Elaine Spector: Thoughts on Mandatory Returns to Office

Elaine Spector Honored with the 2023 Stars of the Bar Award

Vault ‘Quality Of Life’ Rankings: Harrity Named Best Midsize Law Firm To Work For 2024

Harrity & Harrity LLP Achieves High Accolades in IAM Patent 1000 Rankings

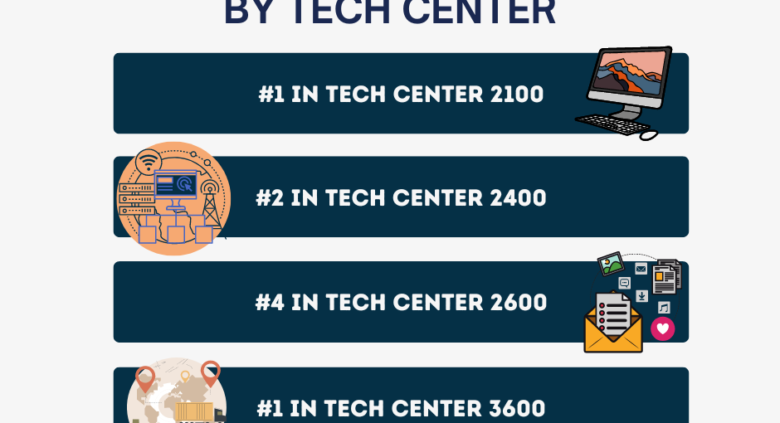

Harrity Named Top 10 Firm in Four USPTO Tech Centers

The Transformative Power of Mentorship: A Spotlight on the Patent Pathways™ Mentor Program

Patent Pathways™ Webinar: Law Firm Partnership Informational Session

Sandra Maxey Featured on World of Marketing Podcast

John Harrity & WashingtonExec’s Rachel Kirkland: American Heart Association’s Lawyers Have Heart 10K, 5K and Fun Walk

Quality is the area that truly separates us from our peers. At Harrity & Harrity, we say that We Patented Quality®, and our second attorney review and uniform writing style ensure that we provide our clients with the highest quality patent preparation and patent prosecution services each and every time.

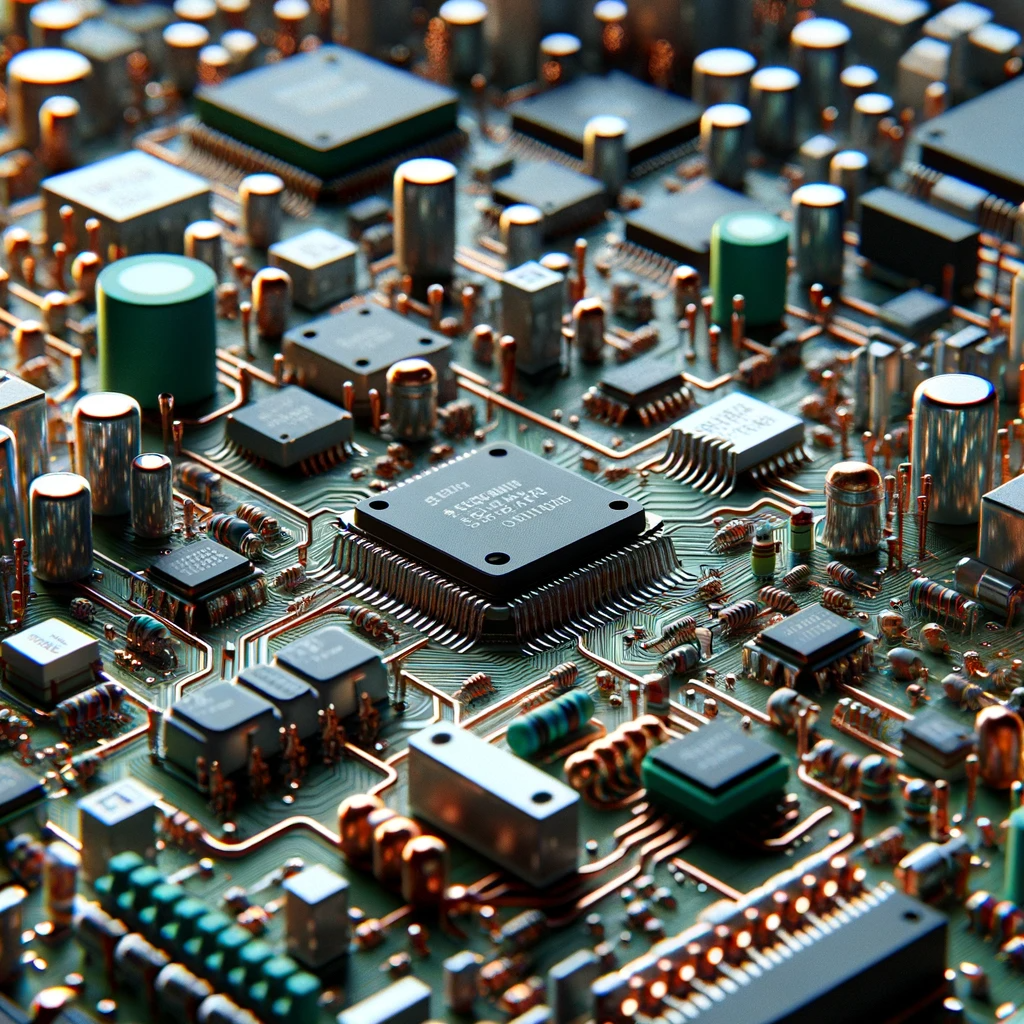

Experience is another area that separates us from our peers. Our professionals have technical backgrounds in electrical engineering, computer science, mechanical engineering, physics, industrial and systems engineering, and civil engineering. We excel at handling any invention in the electrical or mechanical arts.

Innovation is yet another area that separates us from our peers. We strive for excellence, so we track a large number of statistics in order to measure our performance and improve the services we provide to our clients. We also provide our clients with innovative insights into their portfolio through advanced patent analytics.

Client service means everything at our firm. We believe in partnering with our clients to ensure we provide outstanding service. We strive to raise the expectations our clients have for their firms by helping them to understand their own patent portfolios, by saving them time and money, and by acting as though their patent portfolios are our own.

PATENT ATTORNEY/AGENT | FULL-TIME AND REMOTE

Harrity & Harrity, LLP is a 100% remote patent firm. Our professionals prepare and/or prosecute patent applications for leading global technology companies, including numerous Fortune 500 companies.

Our Diversity Mission is to promote and nurture a respectful, highly engaged, family friendly, and inclusive culture that values the diversity of our talented team with diverse backgrounds, experiences, perspectives, skills/talents, and capabilities. Our Diversity Programs are focused on serving our communities by helping to increase the number of diverse legal practitioners and enhancing their quality of practice in patent law.

Now accepting applications and mentors for The Harrity Academy™, Harrity for Parity Women’s Workshop, and Patent Pathways™!