The Evolving Landscape of Automotive Patents Among German Automakers

The patent landscape in the automotive industry has been a topic of interest for stakeholders seeking to navigate the technological advancements and innovations shaping the market. A recent analysis by Harrity Analytics illuminates how the tides have turned in patent acquisition among Germany’s top three automakers—Mercedes, BMW, and Porsche—over the last two decades.

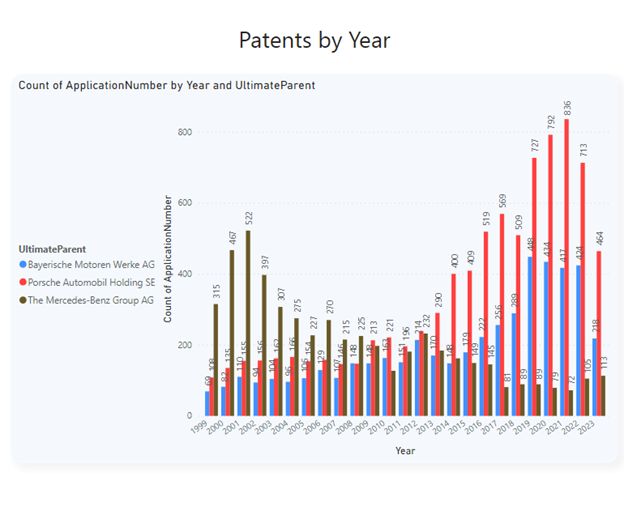

In the early 2000s, Mercedes led the pack in annual patent acquisitions. This period can be characterized as one where Mercedes aggressively sought to protect its intellectual property, a strategy that aligned well with the company’s pursuit of technological leadership in the industry.

However, a noticeable shift occurred around 2010. At this juncture, Mercedes began acquiring fewer patents annually, leveling the playing field for BMW and Porsche. Both companies seized this opportunity and started acquiring patents at a rate that put them in line with Mercedes. The trend suggests a strategic repositioning by BMW and Porsche, possibly driven by a need to catch up with Mercedes’ early lead and to solidify their own footing in rapidly evolving areas like electric vehicles, autonomous driving, and connected services.

The most significant transformation has been observed in the past five to seven years. During this phase, BMW and Porsche have not only caught up but have surpassed Mercedes in annual patent acquisitions. This shift signals a substantial realignment in the industry’s innovation focus, with BMW and Porsche ramping up their efforts to secure technological advancements through intellectual property. Conversely, Mercedes has fallen well behind, prompting questions about its long-term strategy in a landscape increasingly defined by disruptive innovations.

Understanding these shifts is crucial for industry players, investors, and policymakers as it provides insights into the competitive dynamics and innovation strategies of these automakers. The data suggests that while Mercedes may have been an early pioneer, BMW and Porsche have been more agile in adapting to new technological paradigms, as evidenced by their more robust patent portfolios in recent years. It will be interesting to observe how technological advances continue to disrupt the automotive industry and whether these three big players will adjust their patent strategies.

Keep an eye on the Patent 300® Dashboard to see how these trends play out!

Check out our other Patent Analytics services HERE.