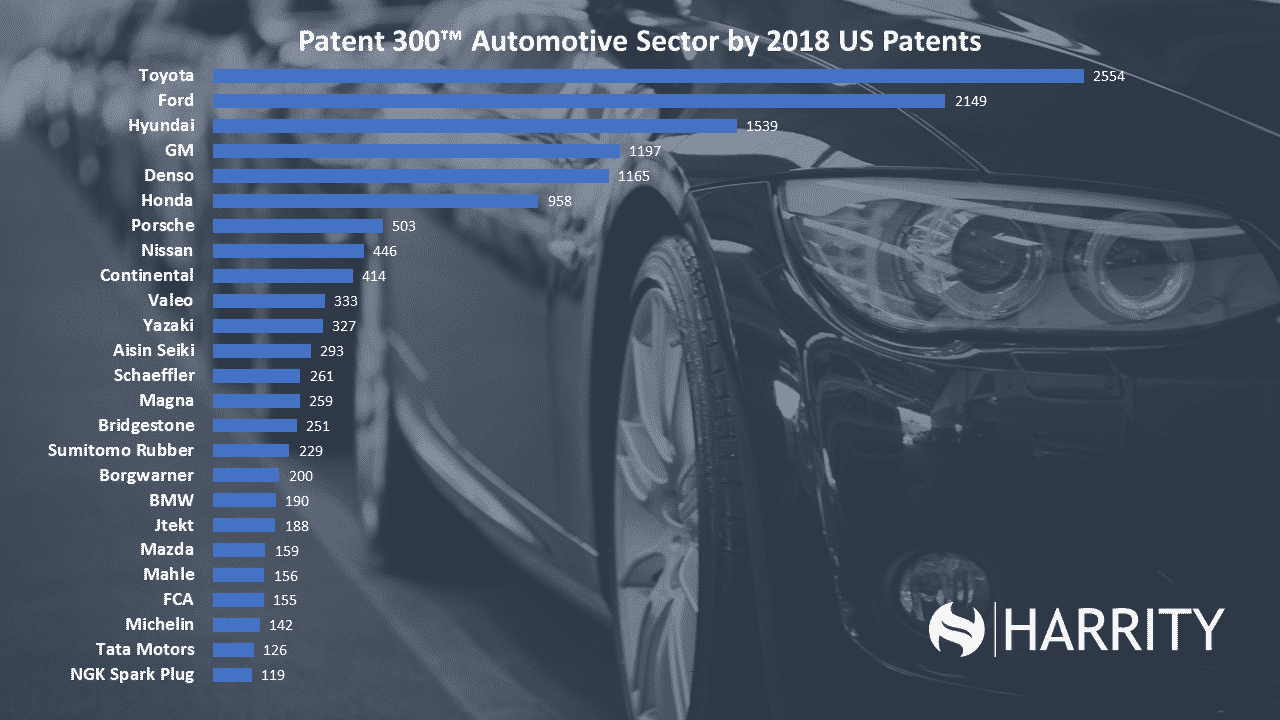

| Alibaba Group Holding Ltd | 2588 |

| Ping An Insurance (group); Company Of China, Ltd. | 2075 |

| Advanced New Technologies Co., Ltd. | 1914 |

| Tencent Holdings Ltd | 1703 |

| Nchain Holdings Limited | 1196 |

| Alipay.com Co., Ltd | 1094 |

| International Business Machines Corp. | 962 |

| Shenzhen Oneconnect Technology Co., Ltd. | 587 |

| China United Network Communications Group Company Limited | 516 |

| Baidu, Inc. | 429 |

| Hangzhou Fuzamei Technology Co., Ltd. | 378 |

| Mastercard Incorporated | 361 |

| Bizmodeline Co Ltd | 320 |

| China Pingan Property Insurance Stock Co., Ltd. | 288 |

| Coinplug,inc | 260 |

| Shenzhen Onething Technology Co., Ltd. | 257 |

| Siemens Ag | 248 |

| Shenzhen Qianhai Webank Co., Ltd. | 244 |

| Shandong Aichengshiwang Information Technology Co., Ltd. | 222 |

| Beijing Aimoruice Science And Technology Co., Ltd. | 222 |

| Accenture Plc | 208 |

| Bank Of China, Ltd. | 199 |

| Visa Inc. | 192 |

| Jiangsu Rongye Technology Company Limited | 187 |

| Shenzhen Launch Tech Company Limited | 186 |

| Microsoft Corporation | 185 |

| Sony Corporation | 182 |

| Huawei Investment & Holding Co., Ltd. | 180 |

| Bank Of America Corporation | 169 |

| Hangzhou Qulian Technology Ltd. | 155 |

| Fujitsu Limited | 154 |

| Taikang Life Insurance Co., Ltd. | 145 |

| Samsung Electronics Co., Ltd. | 145 |

| Intel Corporation | 145 |

| Iallchain Co., Ltd. | 145 |

| Hangzhou Qulian Technology Co.,ltd. | 145 |

| Beijing Jingdong Shangke Information Technology Co., Ltd. | 143 |

| Industrial & Commercial Bank Of China Ltd. | 142 |

| Beijing Aimo Ruice Technology Co., Ltd. | 140 |

| Zhongan Information Technology Services Co., Ltd. | 132 |

| Capital One Financial Corp. | 132 |

| Panasonic Corporation | 129 |

| Guangdong University Of Technology | 123 |

| Dell Technologies Inc. | 123 |

| Nec Corporation | 122 |

| Pingan Ind Co Ltd | 121 |

| Xidian University | 107 |

| Jpmorgan Chase & Co. | 107 |

| Hitachi, Ltd. | 100 |

| Shanghai Dianrong Information Technology Co., Ltd. | 98 |

| Toronto-dominion Bank | 97 |

| Nokia Corporation | 97 |

| University Of Electronic Science And Technology Of China | 94 |

| Hangzhou Yunphant Network Technology Co., Ltd. | 94 |

| Black Gold Coin, Inc. | 90 |

| Robert Bosch Gmbh | 89 |

| One Connect Smart Technology Co., Ltd. (shenzhen) | 89 |

| Lenovo Group Limited | 88 |

| Shandong Icity Network Information Technology Co., Ltd. | 86 |

| Nanjing University Of Posts And Telecommunications | 85 |

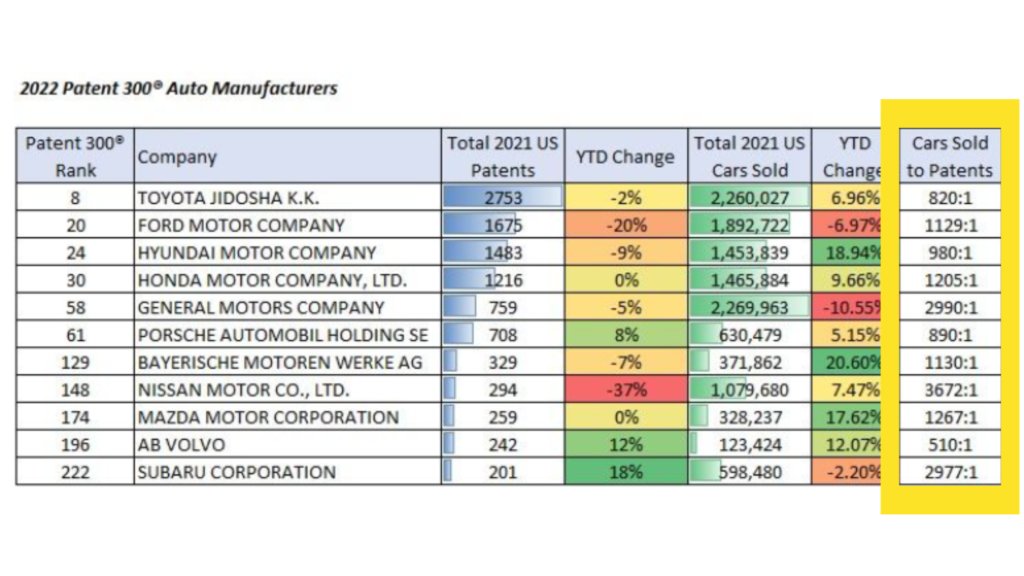

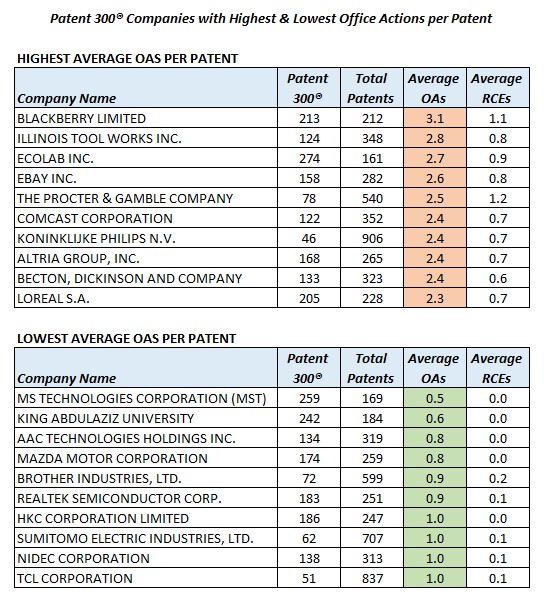

| Toyota Motor Corporation | 82 |

| Beijing Rui Zhuo Xi Tou Technology Development Co., Ltd. | 82 |

| Salesforce.com, Inc. | 81 |

| State Grid Corporation Of China | 80 |

| Chongqing University | 80 |

| Telefonaktiebolaget Lm Ericsson | 78 |

| Hewlett Packard Enterprise Company | 76 |

| Wal-mart Stores, Inc. | 75 |

| China Unionpay Co., Ltd. | 75 |

| Beijing Hai Yi Tong Zhan Information Technology Co., Ltd. | 74 |

| Oracle Corporation | 73 |

| Beijing University Of Posts And Telecommunications | 73 |

| China Southern Power Grid Co Ltd | 72 |

| Chinese Academy Of Sciences | 71 |

| Beijing University Of Technology | 71 |

| Bubi (beijing) Network Technology Co., Ltd. | 70 |

| Ford Motor Company | 69 |

| Webank Spa | 68 |

| Nippon Telegraph & Telephone Corp. | 68 |

| Qihoo 360 Technology Co., Ltd. | 67 |

| Turkcell Iletisim Hizmetleri A.s. | 66 |

| Beijing Ruice Technology Co., Ltd. | 66 |

| Strong Force Tx Portfolio 2018, LLC | 65 |

| The Government Of Germany | 63 |

| Tsinghua University | 63 |

| Paypal Holdings, Inc. | 63 |

| Hangzhou Rivtower Technology Co., Ltd. | 63 |

| Cloudminds (shenzhen) Holdings Co., Ltd. | 63 |

| Shandong Inspur Qualink Technology Co., Ltd. | 62 |

| Electronics And Telecommunications Research Institute | 62 |

| Sap Se | 61 |

| Beihang University | 61 |

| Wuhan University | 60 |

| Deutsche Telekom Ag | 60 |

| Aisino Co., Ltd | 60 |

| General Electric Company | 59 |

| Kt Corporation | 58 |

| Cisco Systems, Inc. | 57 |

| Netmarble Corporation | 56 |

| Shaanxi Medicine Chain Block Chain Group Co., Ltd. | 55 |

| Ygsoft Inc. | 54 |

| China Mobile Communications Corporation | 54 |

| Aowei Information Technology (jiangsu) Co., Ltd. | 54 |

| AT&T Inc. | 53 |

| Sinochem Corporation | 52 |

| State Farm Mutual Automobile Insurance Company | 51 |

| Gold Exchange | 51 |

| Sinochain Tech Co Ltd | 49 |

| Metaps Plus Inc. | 49 |

| Zhejiang University | 48 |

| China Construction Bank | 48 |

| Bt Group Plc | 48 |

| Keb Hana Bank | 47 |

| Zhongshan University | 46 |

| Hunan University | 45 |

| American Express Company | 44 |

| Netease, Inc. | 43 |

| Innogy Se | 43 |

| Instinct Block Chain Technology Co Ltd | 43 |

| Kangjian Information Technology (shenzhen) Co., Ltd. | 42 |

| Jinan University | 42 |

| The Boeing Company | 41 |

| Honeywell International Inc. | 41 |

| Americorp Investments LLC | 41 |

| Tzero Ip, LLC | 40 |

| Zhongchao Credit Card Industry Development Co., Ltd. | 40 |

| Tencent Cloud Computing (beijing) Co., Ltd. | 40 |

| Nippon Soda Co., Ltd. | 40 |

| Myomega Systems Gmbh | 40 |

| Fudan University | 40 |

| Coinbase, Inc. | 40 |

| Anhui Gaoshan Pharmaceutical Co., Ltd. | 40 |

| Shanghai Vechain Information Technology Co., Ltd. | 39 |

| Infobank Corp. | 39 |

| Tenpay Payment Science And Technology Co., Ltd. | 38 |

| Shenzhen Ansike Electronic Tech Co Ltd | 38 |

| Shanghai Jiaotong University | 38 |

| Merck Kgaa | 38 |

| Huazhong University Of Science & Technology | 38 |

| Ebay Inc. | 38 |

| Beijing Octa Innovations Information Technology Co., Ltd. | 38 |

| Nasdaq, Inc. | 37 |

| Jiangsu Hengbao Intelligent System Technology Co., Ltd. | 37 |

| Beijing Peersafe Technology Co., Ltd. | 37 |

| Beijing Oracle Chain Technology Co., Ltd. | 37 |

| Micron Technology, Inc. | 36 |

| Jinan Inspur Hi-tech Investment Development Co., Ltd. | 36 |

| Institute Of Information Engineering Cas | 36 |

| Wells Fargo & Company | 35 |

| Tianjin University | 35 |

| Trueseen Ltd. | 35 |

| Hangzhou Cryptape Technology Co., Ltd. | 35 |

| Zall Research Institute Of Smart Commerce (wuhan) Co., Ltd. | 34 |

| Lizhan | 34 |

| Digital Asset (switzerland) Gmbh | 34 |

| China Zheshang Bank Co Ltd | 34 |

| Beijing Lan Kong Ke Chuang Technology Co. Ltd | 34 |

| Atos Se | 34 |

| United Services Automobile Association | 33 |

| Thales Sa | 33 |

| Sony Group Corporation | 33 |

| Liannong (shenzhen) Information Technology Co., Ltd. | 33 |

| Chengdu Stacs Technology Co., Ltd. | 33 |

| Shenzhen Zhishuilian Technology Co., Ltd. | 32 |

| Shenzhen University | 32 |

| Shanghai Wanxiang Blockchain Inc. | 32 |

| Swirlds, Inc. | 31 |

| Royal Bank Of Canada | 31 |

| Inveniam Capital Partners, Inc. | 31 |

| Hepu Technology Development (beijing) Co., Ltd. | 31 |

| Fisher Rosemount Systems Inc | 31 |

| Beijing Wodong Tianjun Information Technology Co., Ltd. | 31 |

| Beijing Kingsoft Internet Security Software Co. Ltd. | 31 |

| Beijing Institute Of Technology | 31 |

| Beijing Hai Tong Technology Co Ltd Emori | 31 |

| Zhong Information Technology Service Co., Ltd. | 30 |

| Verizon Communications Inc. | 30 |

| Lbxc Co., Ltd. | 30 |

| Inspur Group Co., Ltd. | 30 |

| China Citic Bank Co Ltd | 30 |

| Lapsechain Sa C/o Leax Avocats | 29 |

| Hefei Dappworks Technology Co., Ltd. | 29 |

| Daimler Ag | 29 |

| Beijing Kingsoft Cloud Network Technology Co., Ltd. | 29 |

| Algorand Inc. | 29 |

| Winklevoss Ip, LLC | 28 |

| Sogang University Research & Business Development Foundation | 28 |

| Strong Force Intellectual Capital, LLC | 28 |

| Porsche Automobil Holding Se | 28 |

| Eygs Llp | 28 |

| Guangzhou University | 28 |

| Foshan Yisu Jusen Technology Co., Ltd. | 28 |

| East China Normal University | 28 |

| Avaya Inc | 28 |

| Blockchain Asics, Inc. | 28 |

| Zhejiang Gongshang University | 27 |

| Workday, Inc. | 27 |

| Shimadzu Corporation | 27 |

| Sichuan Homwee Technology Co Ltd | 27 |

| Shanghai Gonglian Information Technology Co., Ltd. | 27 |

| Nhn Corporation | 27 |

| Neusoft Corporation | 27 |

| Modernity Financial Holdings, Ltd. | 27 |

| Chung-ang University | 27 |

| Abmax Biotechnology Co Ltd | 27 |

| Union Mobile Pay Ltd | 26 |

| Shenzhen Golo Chelian Data Technology Co., Ltd. | 26 |

| Shenzhen Leiling Guangtong Technology Research And Development Co., Ltd. | 26 |

| Northern Trust Corporation | 26 |

| Hangzhou Gandao Technology Co., Ltd. | 26 |

| Southeast University | 25 |

| Shenzhen Jiupin Air Purification Technology Co., Ltd. | 25 |

| Shaanxi Medical Chain Blockchain Group Co., Ltd. | 25 |

| R3 Ltd. | 25 |

| Shanghai Youyang Xinmei Information Technology Co., Ltd. | 25 |

| Shanghai Distributed Technologies Co., Ltd. | 25 |

| Ping'an Consumer Finance Co., Ltd. | 25 |

| Peking University | 25 |

| Peking University Shenzhen Graduate School | 25 |

| Institute Of Computing Technology Of The Chinese Academy Of Sciences | 25 |

| Foshan University | 25 |

| Gree Group Co., Ltd. | 25 |

| Beijing Tiandihexing Technology Co., Ltd. | 25 |

| Beijing Haiying Institute Of Science And Technology Information | 25 |

| Vechain Global Technology S.ar.l. | 24 |

| Zte Corporation | 24 |

| Thomson Reuters Corporation | 24 |

| Sichuan Changhong Electric Co., Ltd. | 24 |

| Softbank Corp. | 24 |

| Jindie Software (china) Co., Ltd. | 24 |

| Juzix Technology (shenzhen) Co., Ltd. | 24 |

| Innovative And Advance Technology Co., Ltd. | 24 |

| Fubon Financial Holding Co Ltd. | 24 |

| General Motors Company | 24 |

| Dcun Corporation | 24 |

| Cme Group Inc. | 24 |

| Bitflyer Blockchain, Inc. | 24 |

| Beijing Insight Chain Technology Co., Ltd. | 24 |

| Amazon.com, Inc. | 24 |

| Sichuan University | 23 |

| South China University Of Technology | 23 |

| Shenzhen City Naishidi Technology Development Co. Ltd. | 23 |

| Shanghai Insurance Exchange Co., Ltd. | 23 |

| National University Of Defense Technology Of The Chinese People's Liberation Army | 23 |

| Putian City Zhuhuo Information Technology Co., Ltd. | 23 |

| Nantworks, LLC | 23 |

| Launch Tech Company Limited | 23 |

| Fujian University Of Technology | 23 |

| Denso Corporation | 23 |

| Cryptape Inc. | 23 |

| Boe Technology Group Co. Ltd | 23 |

| Wuxi Jingtum Network Technology Co., Ltd. | 22 |

| Sicpa Holding Sa | 22 |

| Tianjin University Of Technology | 22 |

| Shanghai Vonechain Information Technology Co., Ltd. | 22 |

| Northeastern University | 22 |

| Migu Culture Technology Co., Ltd. | 22 |

| Hunan Tian He Guo Yun Technology Co., Ltd. | 22 |

| Honda Motor Co., Ltd. | 22 |

| Jiangsu University | 22 |

| Hangzhou Dianzi University | 22 |

| Hangzhou Yulan Technology Co., Ltd. | 22 |

| Asahi Kasei Corporation | 22 |

| Beijing Jingdong Zhenshi Information Technology Co., Ltd. | 22 |

| Beijing Blockchain Cloud Technology Co., Ltd. | 22 |

| State Grid Electronic Commerce Co., Ltd. | 21 |

| Tbcasoft, Inc. | 21 |

| Toshiba Corporation | 21 |

| Nomura Research Institute, Ltd. | 21 |

| Motorola Solutions Inc | 21 |

| Nanjing University Of Science And Technology | 21 |

| Kddi Corporation | 21 |

| Hunan Smart Government Block Chain Technology Co., Ltd. | 21 |

| Hp Inc. | 21 |

| Beijing Jd Finance Technology Holding Co., Ltd. | 21 |

| Anhui Lingtuyi Intelligent Technology Co., Ltd. | 21 |

| Zhejiang Shuqin Technology Co., Ltd. | 20 |

| Wuhan Douyu Network Technology Co., Ltd. | 20 |

| Shenzhen Zhongke Zhicheng Technology Co., Ltd. | 20 |

| Ruban Quantum Technology Co., Ltd. | 20 |

| Shenzhen Beiyoutong New Energy Technology Development Co., Ltd. | 20 |

| Nanjing Jinninghui Technology Co., Ltd. | 20 |

| North China Electric Power University | 20 |

| Hefei University Of Technology | 20 |

| Hangzhou Hyperchain Technologies Co., Ltd. | 20 |

| Guangzhou Youpu Electric Power Technology Co., Ltd. | 20 |

| Financial And Risk Organisation Limited | 20 |

| Cooperation Foundation Inje University Industry-academic | 20 |

| Commissariat ? L'?nergie Atomique Et Aux ?nergies Alternatives | 20 |

| Chongqing Huayi Kangdao Technology Co., Ltd. | 20 |

| China Telecom Corporation Limited | 20 |

| Xian Zhigui Internet Technology Co., Ltd. | 19 |

| Zhongsi Boan Technology (beijing) Co., Ltd. | 19 |

| Xiaomi Inc. | 19 |

| Shenzhen Turing Singularity Intelligent Technology Co., Ltd. | 19 |

| Shenzhen Saiante Technology Service Co., Ltd. | 19 |

| Raytheon Technologies Corporation | 19 |

| Ping Identity Corporation | 19 |

| Mitsubishi Heavy Industries, Ltd. | 19 |

| Macrogen Inc | 19 |

| Nanjing Zhongcheng Block Chain Research Institute Co., Ltd. | 19 |

| Fidelity Investments | 19 |

| Giesecke & Devrient Gmbh | 19 |

| Golo Iov Data Technology Co., Ltd. | 19 |

| Dongguk University Industry Academic Cooperation Foundation | 19 |

| Dalian University Of Technology | 19 |

| Akamai Technologies, Inc. | 19 |

| Beijing Arxan Fintech Co., Ltd. | 19 |

| Bitflyer Inc. | 19 |

| Acronis International Gmbh | 19 |

| Beijing Bixing Technology Co., Ltd. | 19 |

| Sk Telecom Co., Ltd. | 18 |

| Tal Education Group | 18 |

| Madisetti, Vijay | 18 |

| Mcafee, LLC | 18 |

| Hyundai Motor Company | 18 |

| J2 Global, Inc. | 18 |

| Innoplexus Ag | 18 |

| Intuit Inc. | 18 |

| Hon Hai Precision Industry Co., Ltd. | 18 |

| Institute For Information Industry | 18 |

| Jingdong Digital Technology Holdings Co., Ltd. | 18 |

| China University Of Geoscience | 18 |

| China Internet Network Information Center | 18 |

| Dareway Software Co., Ltd. | 18 |

| Civic Technologies | 18 |

| Wangsu Science & Technology Co., Ltd. | 17 |

| Xage Security, Inc. | 17 |

| Shigengjian Data Technology (shanghai) Co., Ltd. | 17 |

| Seagate Technology Plc | 17 |

| Shanghai Heshu Software Co., Ltd. | 17 |

| Shandong University | 17 |

| Shanghai Ceying Network Technology Co., Ltd. | 17 |

| Shenzhen Polytechnic | 17 |

| Moneybreak LLC | 17 |

| Mobile Innovations | 17 |

| Mr. Ray, Inc. | 17 |

| Kunming University Of Science And Technology | 17 |

| Hefei Weitian Yuntong Information Science And Technology Co., Ltd. | 17 |

| Kepco Kdn Co Ltd | 17 |

| Guangdong Hongying Technology Co., Ltd. | 17 |

| Endress+hauser (international) Holding Ag | 17 |

| Fulian | 17 |

| Hainan Univ | 17 |

| Chengdu Sefon Software Co., Ltd. | 17 |

| Comcast Corporation | 17 |

| All It Top Co., Ltd. | 17 |

| Baas | 17 |

| Bank Of Taiwan | 17 |

| Beijing Aimo Reechain Science And Technology Co., Ltd. | 17 |

| Vivo Communication Technology Co. Ltd. | 16 |

| Siemens Energy Ag | 16 |

| Strike Protocols Inc. | 16 |

| Simpsx Technologies LLC | 16 |

| Star Mesh LLC | 16 |

| Shenzhen Xiaokong Communication Technology Co., Ltd. | 16 |

| Shenzhen Dianlian Technology Co., Ltd. | 16 |

| Pingan Trust Co., Ltd. | 16 |

| No. 30 Institute Of China Electronic Technology Group Corporation | 16 |

| Kasa Ltd. | 16 |

| Chengdu High-tech Information Technology Research Institute | 16 |

| China Merchants Group Ltd | 16 |

| Cable Television Laboratories Inc | 16 |

| Beijing Technology & Business Univ. | 16 |

| 3m Company | 16 |

| Wenzhou Tusheng Science And Technology Co., Ltd. | 15 |

| Xian University Of Posts And Telecommunications | 15 |

| Tata Sons Ltd | 15 |

| Smartmd | 15 |

| T0.com, Inc. | 15 |

| Tongji University | 15 |

| Shenzhen Great China Blockchain Technology Co., Ltd. | 15 |

| Nanjing Ruixi Information Technology Co., Ltd. | 15 |

| Mitsubishi Electric Corporation | 15 |

| Nanjing Trusted Blockchain And Algorithm Economic Research Institute Co., Ltd. | 15 |

| Netspective Communications LLC Maryland | 15 |

| Pingan International Finance Lease Co., Ltd. | 15 |

| Nike, Inc. | 15 |

| Jiangsu Pay Egis Technology Co., Ltd. | 15 |

| Korea Advanced Institute Of Science And Technology | 15 |

| Johnson Controls International Plc | 15 |

| Hangzhou Shichuang Electronic Technology Co., Ltd. | 15 |

| Foundation Of Soongsil University-industry Cooperation | 15 |

| Guilin University Of Electronic Technology | 15 |

| Dish Network Corp. | 15 |

| Dongguan Monda Plastic-chemical Technology Co., Ltd. | 15 |

| Chunghwa Telecom Co., Ltd. | 15 |

| Beijing Haopukang Technology Co., Ltd. | 15 |

| Ant Blockchain Technology (shanghai) Co., Ltd | 15 |

| Adp, LLC | 15 |

| Anchor Labs | 15 |

| Wealedger Network Technologies Co., Ltd. | 14 |

| Voice Life, Inc. | 14 |

| Zhihuigu (xiamen) Iot Technology Co., Ltd. | 14 |

| Xian Jiaotong Univ | 14 |

| Tcl Corporation | 14 |

| Shenzhen Technology Co Ltd Blue To Di | 14 |

| Suzhou Dajiaying Information Technology Co., Ltd. | 14 |

| Shenzhen Ars(advanced River System) Technology Co., Ltd. | 14 |

| Shenzhen Blockcontinent Technology Co., Ltd. | 14 |

| Puhua Yunchuang Technology (beijing) Co., Ltd. | 14 |

| Obook Inc | 14 |

| Infineon Technologies Ag | 14 |

| Fujifilm Holdings Corp | 14 |

| Cognitive Scale, Inc. | 14 |

| Central South University | 14 |

| Bundesrepublik Deutschland | 14 |

| Commonwealth Scientific & Industrial Research Organisation | 14 |

| Changsha University Of Science And Technology | 14 |

| Beijing Feitian Technologies | 14 |

| Ali Group S.r.l. | 14 |

| A.l.i. Technologies Inc | 14 |

| Beijing Wuzi University | 14 |

| Beatdapp Software Inc. | 14 |

| Yinqing Technology (beijing) Co., Ltd. | 13 |

| Zhejiang Normal Univ. | 13 |

| Ylz Information Technology Co., Ltd. | 13 |

| Xiamen Shunshi Gongshi Information Technology Co., Ltd. | 13 |

| United Parcel Service, Inc. | 13 |

| Xiangtan University | 13 |

| University Of Science And Technology Of China | 13 |

| Soonchunhyang University | 13 |

| Suzhou City Xingji Yuntong Blockchain Technology Co., Ltd. | 13 |

| Suzhou Tongji Blockchain Research Institute Co., Ltd. | 13 |

| Suzhou Inspur Intelligent Software Co., Ltd. | 13 |

| The Walt Disney Company | 13 |

| Skuchain, Inc. | 13 |

| Qilu University Of Technology | 13 |

| Rad Group | 13 |

| Shaanxi Medicine Chain Group Co., Ltd. | 13 |

| Schneider Electric Sa | 13 |

| Securrency, Inc | 13 |

| Shenzhen Lvyuan Huizhi Technology Co., Ltd. | 13 |

| Moog Inc. | 13 |

| Pinganfu Technology Service Co., Ltd. | 13 |

| Monticello Enterprises LLC | 13 |

| Neural Technologies Ltd | 13 |

| Nanjing Reborn Quantum Technology Co., Ltd. | 13 |

| Harbin Engineering University | 13 |

| Jilin University | 13 |

| Iconloop Inc. | 13 |

| Harbin Institute Of Technology | 13 |

| Itext Group Nv | 13 |

| Indexmine. Inc. | 13 |

| Leadpoint | 13 |

| Jiangsu Tongfudun Information Technology Co., Ltd. | 13 |

| Hanyang University | 13 |

| International Trust Machines Corporation | 13 |

| Hangzhou Wopu Iot Technology Co., Ltd. | 13 |

| Guangdong Hongxin E-commerce Technology Co., Ltd. | 13 |

| Facebook, Inc. | 13 |

| Gsc Secrypt, LLC | 13 |

| Chengdu University Of Technology | 13 |

| China Electronic Technology Cyber Security Co., Ltd. | 13 |

| Chongqing Jinvovo Network Technology Co., Ltd. | 13 |

| Chongqing University Of Science And Technology | 13 |

| Beijing Huitong Jincai Information Technology Co., Ltd. | 13 |

| Acer Incorporated | 13 |

| Beijing Guorenbao Technology Co., Ltd. | 13 |

| Abb Ltd | 13 |

| Zhejiang University Of Technology | 12 |

| Wipro Limited | 12 |

| Uni-ledger Technology (beijing) Co., Ltd. | 12 |

| Yantai University | 12 |

| Way2bit Co. Ltd. | 12 |

| Xerox Corporation | 12 |

| Wistron Corporation | 12 |

| University Of Science And Technology Beijing | 12 |

| Yonsei University | 12 |

| Tmrw Foundation Ip And Holding Sarl | 12 |

| Shenzhen Qianhai Wealedger Network Technology Co., Ltd. | 12 |

| Seiko Epson Corporation | 12 |

| Shanghai Development Center Of Computer Software Technology | 12 |

| Shandong Inspur Cloud Service Information Technology Co., Ltd. | 12 |

| Security Matters Ltd. | 12 |

| Shanghai Qiyin Information Technology Co Ltd | 12 |

| Quliantong Network Co., Ltd. | 12 |

| Refinitiv Us Organization LLC | 12 |

| National Computer Network And Information Security Management Center | 12 |

| Markany Inc | 12 |

| Mocana Corp. | 12 |

| Orange Sa | 12 |

| Mythical, Inc. | 12 |

| Ncr Corporation | 12 |

| Pingan Yiqianbao E-commerce Co., Ltd. | 12 |

| Nanjing University | 12 |

| Loyyal Corporation | 12 |

| Medibloc Co., Ltd. | 12 |

| International Game Technology Plc | 12 |

| Lg Electronics Inc. | 12 |

| Korea University | 12 |

| Information And Telecommunication Branch Of State Grid Anhui Electric Power Company | 12 |

| Kyocera Corporation | 12 |

| Jiangxi University Of Science And Technology | 12 |

| Korea Minting Security Printing & Id Card Operating Corp | 12 |

| Guangzhou Zhihong Electronic Technology Co., Ltd. | 12 |

| Guangzhou Yuejian Sanhe Software Co.,ltd. | 12 |

| Goldman Sachs Group, Inc. | 12 |

| Guangdong Hongxin Enterprise Service Co., Ltd. | 12 |

| Guangxi University | 12 |

| Ebaonet Healthcare Information Technology (beijing) Co., Ltd. | 12 |

| Digital Asset Holdings, LLC | 12 |

| China Academy Of Information And Communications Technology | 12 |

| Chronicled, Inc. | 12 |

| Advent International Corporation | 12 |

| Adobe Inc. | 12 |

| Beijing Yuanlangchao Technology Co., Ltd. | 12 |

| Anhui University Of Science & Technology | 12 |

| Bayerische Motoren Werke Ag | 12 |

| Beijing Thinkey Technologies Co., Ltd. | 12 |

| Zhengzhou University | 11 |

| Zhengzhou Normal Univ | 11 |

| Xiamen Keruisheng Technology Co., Ltd. | 11 |

| Smartsky Networks LLC | 11 |

| Silictec (shenzhen) Electronic Technology Co., Ltd. | 11 |

| The Carlyle Group, L.p. | 11 |

| Shimano Inc. | 11 |

| Shenzhen Qianhai Huanrong Lianyi Information Technology Service Co., Ltd. | 11 |

| State Grid Block Chain Technology (beijing) Company | 11 |

| Stringon Technology (beijing) Co., Ltd. | 11 |

| Renmin University Of China | 11 |

| Shanxi Texin Huanyu Information Technology Co., Ltd. | 11 |

| Shandong Daige Information Technology Co., Ltd. | 11 |

| Qufu Normal University | 11 |

| Sensoriant, Inc. | 11 |

| Quantum Gate Inc. | 11 |

| Shandong Inspur Co Ltd | 11 |

| Linkeychain Intelligent Technology (shanghai) Co., Ltd. | 11 |

| Liquineq Ag | 11 |

| Line Plus Corporation | 11 |

| Hangzhou Zhikuai Network Technology Co., Ltd. | 11 |

| Korea Information Security Management Institute | 11 |

| Hasan, Syed | 11 |

| Kunming Dabangke Technology Co., Ltd. | 11 |

| Industrial Technology Research Institute | 11 |

| Guangzhou Yibite Blockchain Technology Co., Ltd. | 11 |

| Gk8 Ltd. | 11 |

| Gulbrandsen, Magnus | 11 |

| Guangxi Normal University | 11 |

| Dongyuan (beijing) Digital Technology Co., Ltd. | 11 |

| Edvanst Nyu Teknolodzhiz Ko., Ltd. | 11 |

| Core Scientific, Inc. | 11 |

| Cssc Systems Engineering Research Institute | 11 |

| Chongqing Huihui Information Technology Co., Ltd. | 11 |

| Beijing Zhibangbang Technology Co., Ltd. | 11 |

| Blockchain Inc. | 11 |

| Biovoice Information Technology Co., Ltd. | 11 |

| Blockchain Asics LLC | 11 |

| Block Chain Security Corp. | 11 |

| Ai Biomaterial Healthtech Ltd. | 11 |

| Agricultural Bank Of China | 11 |

| Tzero Group, Inc. | 10 |

| Uvue Ltd | 10 |

| Yangzhou University | 10 |

| Zamna Technologies Limited | 10 |

| Yocto Technologies, S.l. | 10 |

| Vechain Foundation Limited | 10 |

| Shenzhen Zhonghui Zhiti Technology Co., Ltd. | 10 |

| Southern University Of Science And Technology | 10 |

| The Industry & Academic Cooperation In Chungnam National University Iac | 10 |

| Telefonica S.a. | 10 |

| Tianyi Electronic Commerce Co., Ltd. | 10 |

| Shenzhen Yilian Information System Co., Ltd. | 10 |

| Terminus Technologies, Inc. | 10 |

| Shanghai Wurong Intelligent Technology Co., Ltd. | 10 |

| Shanghai Mohe Network Technology Co., Ltd. | 10 |

| Quark Chain Technology (shenzhen) Co., Ltd. | 10 |

| Shenzhen Fanxi Electronics Co., Ltd. | 10 |

| Ruiya Blockchain Technology (shenzhen) Co., Ltd. | 10 |

| Shenzhen Fubei Technology Co., Ltd. | 10 |

| Shanghai Yuanlu Jiajia Information Science And Technology Co., Ltd. | 10 |

| Servicenow, Inc. | 10 |

| Shenzhen Buyun Technology Co., Ltd. | 10 |

| Shanghai Jianshi Network Technology Co., Ltd. | 10 |

| Sf Tech Co., Ltd. | 10 |

| Meilai Network Technology (shanghai) Co., Ltd. | 10 |

| Linius (aust) Pty Ltd | 10 |

| Northwestern University | 10 |

| Nok Nok Labs, Inc. | 10 |

| Nantong University | 10 |

| Platon Sa | 10 |

| Nanjing Institute Of Technology | 10 |

| Mobilitie, LLC | 10 |

| Nexon Co., Ltd. | 10 |

| Ningbo Fuwan Information Technology Co., Ltd. | 10 |

| Jiangsu Peerfintech Technology Co., Ltd. | 10 |

| Jiangsu Hengwei Information Technology Co., Ltd. | 10 |

| Hohai Univ. | 10 |

| Jiangsu Worldallwell Holdings Co., Ltd. | 10 |

| Koch Industries | 10 |

| Lapsechain Sa | 10 |

| Leverage Rock LLC | 10 |

| Jiangsu Aowei Holdings Co., Ltd. | 10 |

| Infrared5 Inc. | 10 |

| Lianqi Technology (beijing) Co., Ltd. | 10 |

| Eluvio, Inc. | 10 |

| Farmobile, LLC | 10 |

| Fuzhou University | 10 |

| Guangzhou Block Zero Chain Technology Co., Ltd. | 10 |

| Eight Plus Ventures, LLC | 10 |

| Dongguan Dayi Industry Chain Service Co., Ltd. | 10 |

| Domos, LLC | 10 |

| Chengdu Lingguang Quantum Technology Co Ltd | 10 |

| China University Of Petroleum | 10 |

| Digitalzone Co., Ltd. | 10 |

| Chengdu Shangtongshidai Digital Technology Co., Ltd. | 10 |

| Cambridge Blockchain, Inc. | 10 |

| Ccb Fintech Co., Ltd. | 10 |

| Chongqing Xiaoyudian Small Loan Co., Ltd. | 10 |

| Cheju National University Industry-academic Cooperation Foundation | 10 |

| Beijing Tianyi Science Trade Co | 10 |

| Beijing Jiaotong University | 10 |

| Beijing Tus Data Asset Technology Development Co., Ltd. | 10 |

| Barclays Execution Services Limited | 10 |

| Axell Corporation | 10 |

| Balanced Media Technology, LLC | 10 |

| Ajou University | 10 |

.jpg)