By Rocky Berndsen, Head of Analytics

Continuation practice in US patent law refers to a procedure where an applicant files a subsequent application based on the disclosure of a prior non-provisional application, while the prior application is still pending. This strategy can be used for various reasons, such as refining claims, pursuing different scopes of protection, or keeping a patent family alive as the business strategy or technology develops. The Patent 300® data, focusing on the highest and lowest percentages of patents issued in 2023 that were continuations, provides fascinating insights into the innovation and patenting strategies of top companies.

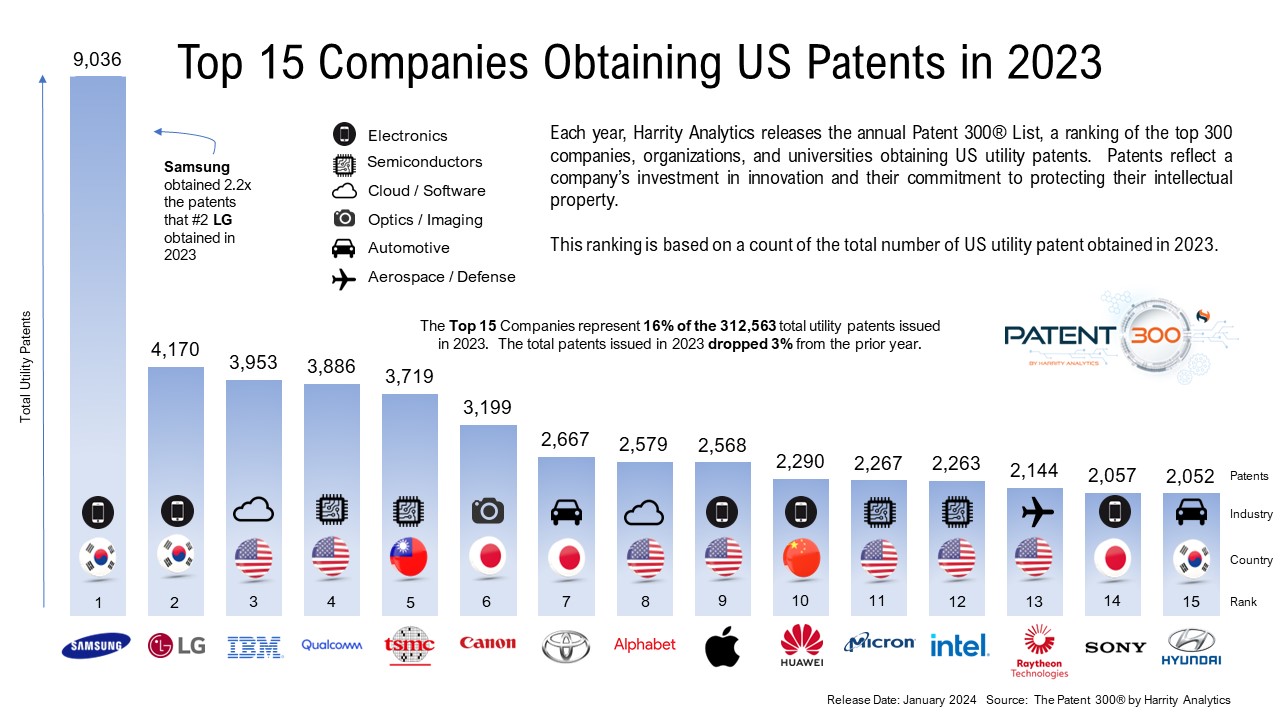

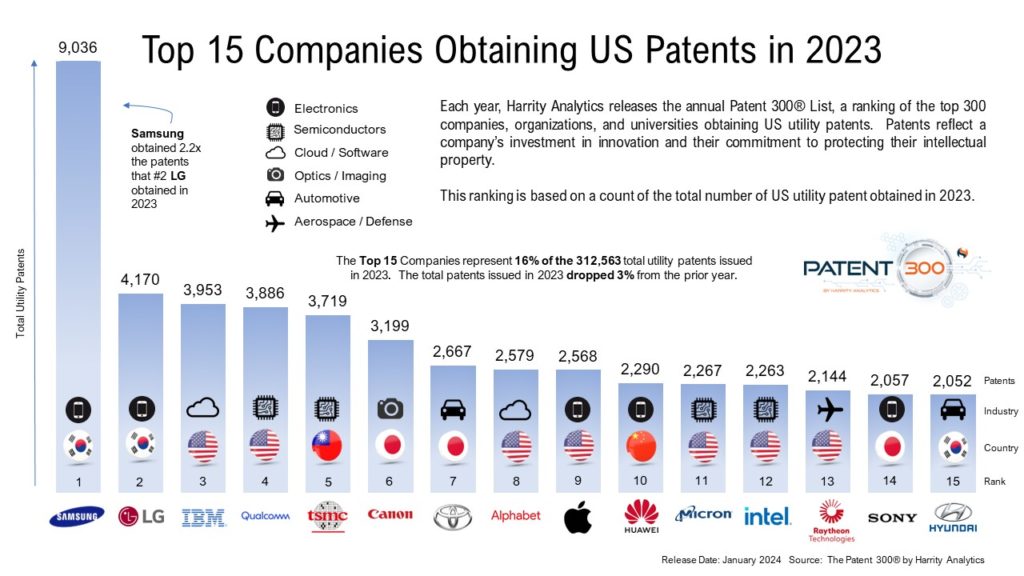

Strategic Use of Continuation Practice Found in Numerous Industries

The chart above indicates that companies like Sonos, Edwards Life Sciences, and Ebay lead with the highest continuation percentages. For example, the data shows that 88% of Sonos’ patents issuing in 2023 were continuation applications. This approach suggests a targeted approach to innovation, where companies are keen on fortifying their market position by building robust patent portfolios around their core products and services. Continuation practice allows these companies to create a thicket of patents, making it harder for competitors to navigate without infringing. It also provides them the flexibility to adapt to technological advancements and market changes by updating or expanding their patent claims.

Moreover, continuation practice might be indicative of a strategic layering of patent protection that enables companies to keep certain innovations under initial protection while testing the market or developing further improvements. For companies like Palantir and Dolby, whose products involve complex software or hardware, the ability to file continuations means they may have the ability to continually update their patent claims to cover the latest iterations of their technology.

Continuation applications can also serve as a legal strategy to keep competitors uncertain about the final form of the patent claims, which could deter potential infringement or at least make it more difficult for competitors to design around an applicant’s patent portfolio.

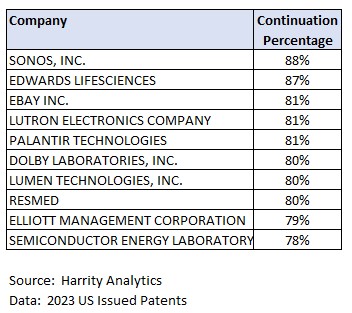

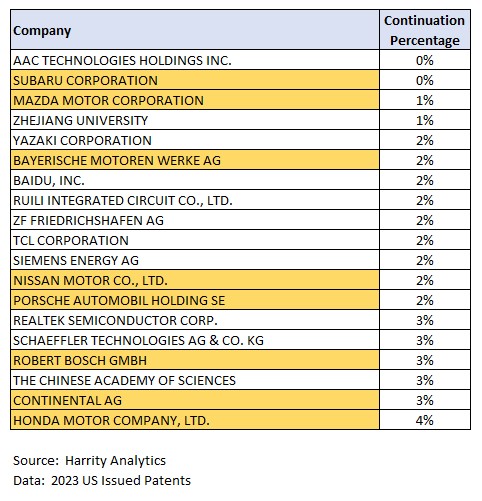

Why are some companies not filing many continuation applications at all?

The Patent 300® data also reveals a set of companies that utilize continuation practices minimally in their patenting efforts. Notably, this list includes a significant number of automotive manufacturers, highlighted above, such as Subaru, Mazda, and Honda, all showing low continuation percentages. This pattern could suggest a distinct approach to portfolio management within the automotive industry, where innovation is rapid and product development cycles are aligned with manufacturing and release schedules.

Another reason for the minimal use of continuation practice could be budgetary constraints. Continuation applications incur additional costs, not just in filing fees but also in legal and administrative expenses over time. For some companies, the cost of maintaining a high number of continuations may not justify the potential benefits. Some companies may opt to instead focus on obtaining patents for newly developed technologies.

Additionally, the strategy behind claims could influence the use of continuation practice. Companies may choose to file comprehensive initial patent applications with broad claims to cover their inventions fully from the outset. This approach could reduce the need for subsequent continuation applications to refine or broaden the scope of the original claims. Some companies may prioritize filing detailed applications that anticipate future product developments, thereby lessening the need for continuations.

Moreover, the breadth of patenting may reflect an applicant’s innovation strategy. Companies with a wider range of products and services may prefer to obtain a broader spread of original patents rather than deepening the protection around a narrower technology area through continuations. This approach can create a more extensive barrier to entry for competitors across a wider technology landscape. Automotive companies, with their frequent iterations of vehicle models and technologies, might find more value in creating a broad patent portfolio that covers a range of innovations rather than focusing on continuing applications for specific technologies.

In sum, the Patent 300® data offers a revealing glimpse into the nuanced strategies behind continuation practices in patent law. While certain companies leverage this mechanism to build a dense web of protection around key products, adapting to market and technological shifts, others in sectors like automotive opt for a broader innovation footprint, potentially driven by cost considerations, a preference for comprehensive initial filings, or the strategic spread of their patent efforts across a wider range of technologies. These divergent approaches underscore the complexity of IP management, where each applicant crafts a strategy aligned with its business goals, market position, and the dynamic landscape of technological advancement. The data not only reflects the tactical choices of individual companies but also illustrates broader industry trends in patenting, revealing the careful balance between depth and breadth in securing intellectual property rights.